If you would like more than 8 samples, please contact a trader directly.

Cart

A trader will contact you with shipping and payment options after checkout. Please note: free samples are provided to commercial roasting businesses only.

As we entered the 2020/2021 Kenyan harvest everyone was talking about low volumes and high prices. Low volumes, in a country that already exports less coffee every year. High prices, in a country that already commands the highest premium. All of this, at a time when roasters are struggling through quarantine. “Who would be looking for tasty, but pricey micro-lots at a time like this?” we thought. We hoped for the best and planned for the worst.

The harvest came in and what we got was more than we had hoped for! Come along as we recap the 2021 harvest and take a look at the communities that we will be representing. Coffees are setting sail now, with containers arriving throughout June and July.

Early rains made for an early harvest and a short off-season in Kenya. The off-season seemed even shorter with limited activity during quarantine. We have not been able to visit since January of 2020; so we dug deep into our partnership network to solicit samples from all corners of the country.

Samples came through estates, coops, marketing agents, exporters, and a diverse team of cuppers. And they were good. While we expected to only maintain this year, our 2021 imports actually built off of last year in a few meaningful ways.

First, we love seeing success in our older relationships. It was these long-term partners who won this year in terms of both quality and price. We were able to scale up last year’s initial work in Bungoma, the Western Rift Valley. We are bringing to market new suppliers some of which are new to specialty, but all of whom we’ve been wanting to work with for years. Check out our 2020 Harvest Update for more background on our approach and partnerships in Kenya.

Normal harvests yield ~15 bags green/hectare of cultivated coffee. This year, the yield is coming in at about half of that. Prices have risen 30-40c on average over last year due to the short supply. But that doesn’t paint the full picture.

Normally, AA grades enjoy a healthy premium over AB grades by about 25%. But high prices have moved some buyers from AAs to ABs. This has increased the demand for ABs and narrowed the premium gap to about 2.5%. It also left many AAs unsold week over week.

Moreover, coffees from the Central Highlands typically enjoy a premium over Western Rift Valley and Eastern Provinces. This is mostly due to name recognition and aggregate quality. Those price differences disappeared this year. And because of that, we will be seeing a lot more coffee from outside of the Central Highlands and much more incentive for investment in those areas going into the next harvest.

Growers had extra time between quarantine and a short season. Some used this to pursue processing experiments which is not something you see much of in Kenya but it seems to be growing more and more each year. For example, naturals are called ‘buni’ and are traditionally the very worst quality. Buni is what’s left after the proper picking has been done. In the past, attempts at floated, selective naturals have failed to match the qualities of their washed counterparts. This year we received a few scalable experiments (20+ bags) that showed potential for a good natural-processed Kenyan.

In Bungoma, we revisited past partners Chwele and Kimama, and with the team at Kahawa Bora, put together a “best of” blend to showcase the unique profile that is possible from this region. While these coffees are safe to score as a solid 86, 86.5, they are distinct and deserving of merit attention beyond their number.

Giakanja separated their crop into three deliveries–as opposed to 6 last year. The first of these came in week 10. This represented the first pickings of the season where expectations on quality are usually lower. We were pleasantly surprised to see it cupped above 87 with the pleasantly popping grapefruit – peach – sugar – yuzu notes that we’ve come to love. After this feedback, the group separated out another delivery on week 13, which matches this and built on the body with notes of creamy honey and cantaloupe.

In addition to these highlights, long-time listeners will see other names they recognize. For example, Kanake is back tasting like currant cola. Gicherori is also back with its unique tamarind twist. And finally, Kiandu whose cupping notes read like the recipe for peach crumble.

New communities we’re excited to introduce include the following:

– Ciumenene Estate, a group we hope to grow with. They are making their debut with a small lot that cups up like honey jasmine and white grape.

– New to us, is a group from Ndundu-ini, who is allowing us to spike our offer list with notes of ‘blackberry jam’ and ‘candied lavender’.

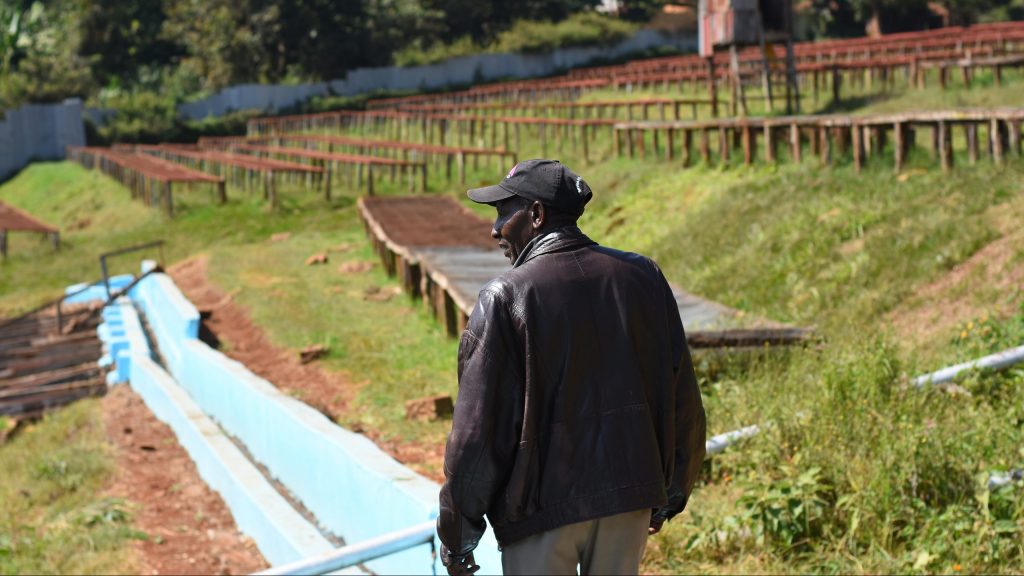

Factory staff at Chwele FCS- photo taken just after they learned their coffee won a Good Food Award!

2021 exports are coming through three different supply-chains, with most arrivals June – July. Contact your Crop to Cup representative to put in a reserve and sign-up for samples.